Please note: We are not a legal firm and do not provide legal advice. This article is for informational purposes only. Please consult with a qualified attorney before implementing any practices discussed here.

If you're a Texas restaurant owner, manager, or accountant, you need to understand the finer points of tipping in Texas. Can owners take tips and distribute them later? Do tip pooling laws apply to all members of staff, including front- and back-of-house?

These questions are common, yet many restaurateurs don't understand the finer points of the laws pertaining to tipped employees. This can land owners in hot water, like the leadership team at the Roanoke eatery ordered to pay over $860K in stolen tips and overtime. Protect yourself from fines, unnecessary payouts, and staff walkouts by learning the laws about collected tips in Texas.

The Federal Minimum Wage in 2025 is $7.25 an hour. Unlike some states that have a higher minimum wage, Texas follows the national minimum. For tipped employees, you only have to pay a certain amount if that employee can make the rest up in tips. You must pay a minimum of $2.13 an hour, which seems like it could be a massive saving for restaurant owners. However, you must also ensure that the tips received bring that amount up to $7.25. In other words, employees getting paid $2.13 per hour must earn an extra $5.12 per hour in tips.

This is known as a tip credit. Tip credits allow you as an employer to show that you are providing a minimum wage by combining hourly pay and tips. You can only use tip credits in Texas if:

You also need to let your employees know that this is how they're being paid. While not mandatory by Texas state law, a lack of transparency could impact staff turnover and satisfaction. For example, if you simply tell new starters that they get minimum wage without explaining tip credits, they may expect all their tips on top of minimum wage. When they don't receive this, they're unlikely to continue working at your restaurant. They could even impact your reputation negatively by sharing their poor experiences with others in-person and online.

Tips that total $20 or more per calendar month are taxable in Texas and must be reported to the IRS. These can be declared on each employee's Form W-2.

In your restaurant, you may have noticed that one server gets all the tips, and others seem to get none—even though they both provide excellent service. A tip pool is a way to ensure fairness.

Tip pooling means that tips go into a central pool and then get shared fairly among staff who are eligible for tips. Restaurant owners engaging in tip pooling in Texas must follow these regulations:

Voluntary tip sharing is another option. This is less regulated as employees opt-in to voluntarily share their tips with other members of the team. For example, a host who works hard rarely gets tips because the social convention is to tip your table server. With tip sharing, a host could receive a percentage of all the tips taken each day.

Restaurant owners in Texas are responsible for ensuring tips are distributed evenly and fairly. They can also require employees to engage in a tip pool as long as they notify employees in advance that this is how their tips will be handled. If the amount from the tip pool does not cover minimum wage for each employee (minus the mandatory $2.13), employers must make up the difference.

In addition to the Texas-specific regulations, it is important to understand federal guidelines on tip pooling and sharing. According to the U.S. Department of Labor, tip-pooling arrangements are permissible provided that the employees participating have contributed to the service experience of the customers who left the tips. Generally, back-of-house staff like cooks and dishwashers are ineligible unless the restaurant pays tipped employees the full minimum wage without a tip credit. However, there's some leeway for certain roles that interact with customers, like hosts or food runners. Consulting court cases like Kilgore v. Outback Steakhouse (hosts) or Budrow v. Dave & Busters (bartenders who don't serve tables directly) can provide more specific examples.

Furthermore, any tip pool contributions must be reasonable, typically not exceeding 15 percent of the employee's tips. Employers should document tip-pooling policies clearly and ensure that the distribution of tips aligns with the regular pay schedule to maintain compliance with 29 C.F.R. § 531.54. By understanding these nuances, restaurant owners in Texas can ensure their tip pooling arrangements comply with regulations and promote a fair system for all staff involved.

What is a service charge? Unlike a tip or gratuity, which is a voluntary contribution given by a diner or guest for excellent service, a mandatory service charge is a surcharge the restaurant adds for a particular reason. Common reasons to add a service charge include:

Unlike a tip, service charges usually go to the restaurant, not the server. In Texas, the law states that employees have no right to count service charges as part of their tip. Therefore, there is no obligation for Texas restaurant owners to distribute service charges. They can be counted as part of the restaurant's revenue.

Restaurant managers should, however, make sure that employees understand this law so they don't expect more than they're entitled to. Owners can also voluntarily set a policy of sharing a portion of the service charge with employees. This could be used as an incentive to book large parties, or even as a recruitment tactic.

TipHaus Tip: Leverage your mandatory service charge to build a commission-based compensation model for your team. By allocating a portion of the service charge to employees based on their individual sales or contributions, you can create a structured, performance-driven reward system. This approach ensures employees are incentivized to enhance guest experiences while keeping billing clear and transparent for customers. It’s a win-win that drives both team motivation and customer satisfaction.

Some restaurant owners may think they can recoup credit card processing fees by taking them out of employees' tips. In Texas, this is legal and allowed with some limitations.

To protect tipped employees, restaurant owners could add a service charge to a check to ensure the credit card processing fee is covered. However, they're not required to do this by law. As covered earlier in the article, it's good business sense to ensure staff understand any deductions that may be made from their tips.

Tipped employees in Texas deserve to be treated fairly. While employers can legally demand that their staff report all tips, owners and managers should never take any tips for themselves or demand a cut of a tipping pool. The same applies to manual tip jars — it's management's responsibility to ensure these tips are distributed fairly among team members.

Common misconceptions among restaurant owners include:

None of these Texas tip myths are true. Tips always belong to the employees and are only handled by management when arranging tip credits, deducting card processing fees, or distributing money as part of tip pooling or sharing. Plus, employers must ensure that at least $2.13 an hour is paid by the restaurant to tipped employees.

Tipped employees can end up being unfairly treated by restaurant owners who don't understand Texas state law. However, the law protects restaurant workers and their tips, and owners who fail to comply can face hefty fines or even prosecution. Owners can help their team feel safe and looked after by being completely transparent about the company's tipping policies. Proactively showing how you meet Texas state laws in relation to tipping helps reassure employees that you have their best interests at heart.

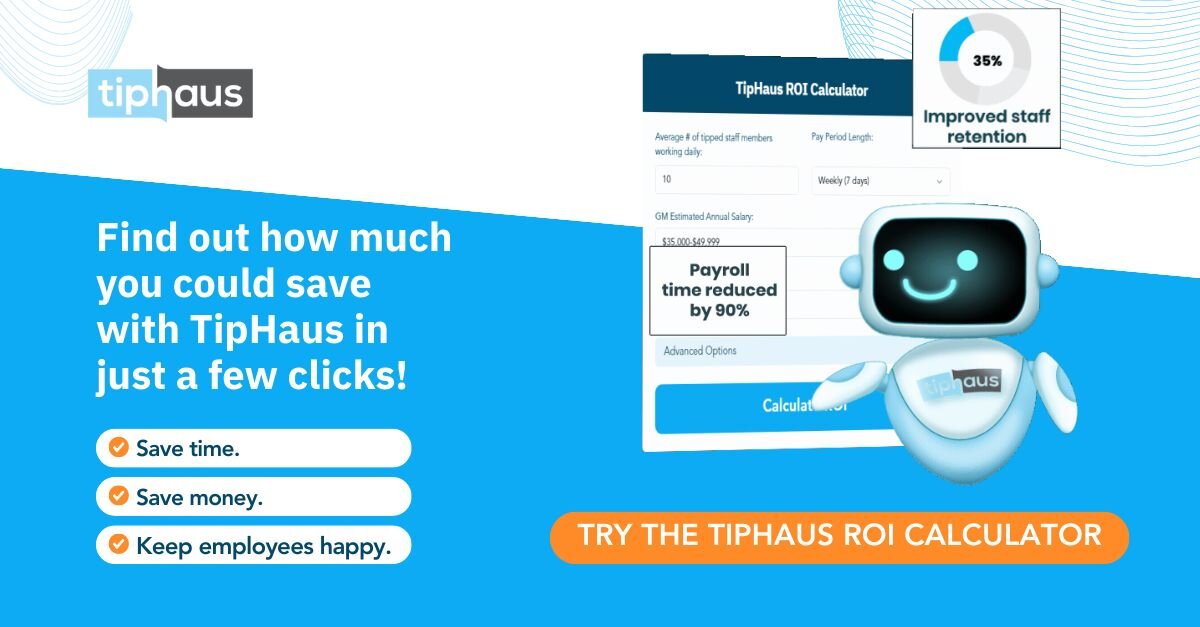

Thankfully, restaurant owners and accountants in Texas have plenty of resources available to help them navigate the challenges of tipping legalities. Legal resource NOLO has plenty of information on tipping in Texas and the related laws. You can also invest in tipping software to take the headache out of calculating tips and payments. Earned tips can be given as digital payouts, helping your employees manage their money better. Find out more by emailing sales@tiphaus.com or click here to book a demo with TipHaus.