Please note: We are not a legal firm and do not provide legal advice. This article is for informational purposes only. Consult with a qualified attorney before implementing any practices discussed herein.

Tipping in Florida restaurants is commonplace as diners love to show their appreciation for excellent service.

It's critical, then, that Florida restaurant owners and accountants understand the legalities of handling tipped employees. Many misconceptions surround tipping, such as tips making an entire wage packet or owners being able to take a cut of tips. Knowing the facts helps restaurants remain compliant with the law and maintain better relationships with employees.

The federal minimum wage is currently $7.25 per hour.

The state minimum wage in Florida is $13 an hour as of 2025. Employers can only take a tip credit of $3.02 per hour in Florida. That means they must pay a base wage of at least $9.98 per hour, more if the employee doesn't make at least $3.02 an hour in tips. This minimum wage applies to all restaurant employees, including tipped employees. However, employers can take a tip credit in Florida and many other states. A tip credit means the employer uses a portion of the tips the employee receives to make up the minimum wage.

Employers can only take a tip credit of $3.02 per hour in Florida. That means they must pay a base wage of at least $9.98 per hour, more if the employee doesn't make at least $3.02 an hour in tips.

TipHaus Tip: To ensure compliance with Florida tip credit regulations, employers must:

In some establishments, employees may pool their tips rather than simply holding onto their own. In Florida, federal tip pooling laws apply with no state-specific differentiations. Owners can require employees to pool collected tips as long as they ensure staff members know this before starting their shifts. Tip pooling can help ensure hosts and other employees who typically see fewer tips can enjoy additional income.

Employers will normally define the percentage of tips collected that need to go into the pool. The only legal proviso on the amount is that distributed tips must ensure everyone meets at least minimum wage. It's also illegal to ask employees to share tips with non-tipped staff, such as chefs and other back-of-house staff.

Employers must not keep any portion of a tip pool or tip-sharing scheme. Collected tips must always go back to the employees, even if that's as tip credit in their wages. Tipping software can be very useful for tip pooling, helping owners quickly distribute accurate digital payouts.

Please note: Tips must always be voluntary, with the diner choosing the amount and who receives the money (before tip pooling or sharing).

Mario Padrino, owner of Padrino's Cuban Restaurants in Florida, shares how Earned Tip Access transformed their end-of-shift routine and strengthened relationships between staff and managers. With nearly 90% of payments coming through credit cards, managing nightly cash tipouts had become a major operational pain. TipHaus brought clarity, speed, and calm to the process.

Some restaurants add a service charge to their bills. Diners may believe this is an "included tip" and not leave anything additional. But it's not a tip, so what is a service charge?

A mandatory service charge is usually added to cover additional costs for large parties or catering events. It implies that the restaurant has made a special effort to provide this meal or event, which is why it's a little more expensive. However, tipped employees have no right to this service charge in Florida. This money goes toward restaurant revenue.

As of 2025, Florida law requires restaurants to disclose the purpose of any mandatory service charges and explicitly state that they are not tips unless shared with employees. This mandatory transparency helps diners understand charges while promoting fair tipping practices.

Also, if an employer decides to share service charges with employees, they must count them as wages, not tips.

In a commission-based compensation model, employees earn a percentage of sales instead of relying solely on traditional tips. This model is facilitated by introducing a service charge on guest bills, which is then distributed among the team based on their roles or a set percentage. Here's how it works in practice:

For example, a restaurant might implement a 20% service charge, distributing 12% to servers, 3% to support staff, and the remaining 5% as a BOH pool or management incentive.

This approach also opens the door for restaurants to take advantage of the 7(i) exemption under the Fair Labor Standards Act (FLSA). By ensuring that more than 50% of an employee’s earnings come from commissions, operators can legally pay employees a flat hourly rate without triggering overtime requirements, provided other conditions are met. TipHaus helps operators track and manage these earnings accurately, ensuring full compliance with Florida’s labor laws while giving staff the opportunity to earn livable wages at a single job.

Listen to Andrei Stern, co-founder of SuViche Hospitality Group, as he shares his experience transitioning from traditional tipping to service charges and commission-based compensation in his restaurants, including how they successfully implemented the change.

Card companies issue credit card processing fees for the privilege of using their payment services. The restaurant pays this fee, but in some states, it can deduct a portion of it from the employee's tips.

In Florida, this is illegal. The law states that tips are the sole property of the employee, and employers cannot use them to cover any operating costs.

The priority for all employers should be protecting tipped workers' rights. This cements your restaurant as a fair workplace, attracting top talent and more guests.

Can owners take tips from employees? Absolutely not, although they may take tip credits and handle tips for distribution when running a tip pool. Similarly, tips can't be used to cover credit card processing fees or other running costs. However, service charges are never the employee's property unless the restaurant owner decides otherwise. More resources on state tipping laws are available on the U.S. Department of Labor site.

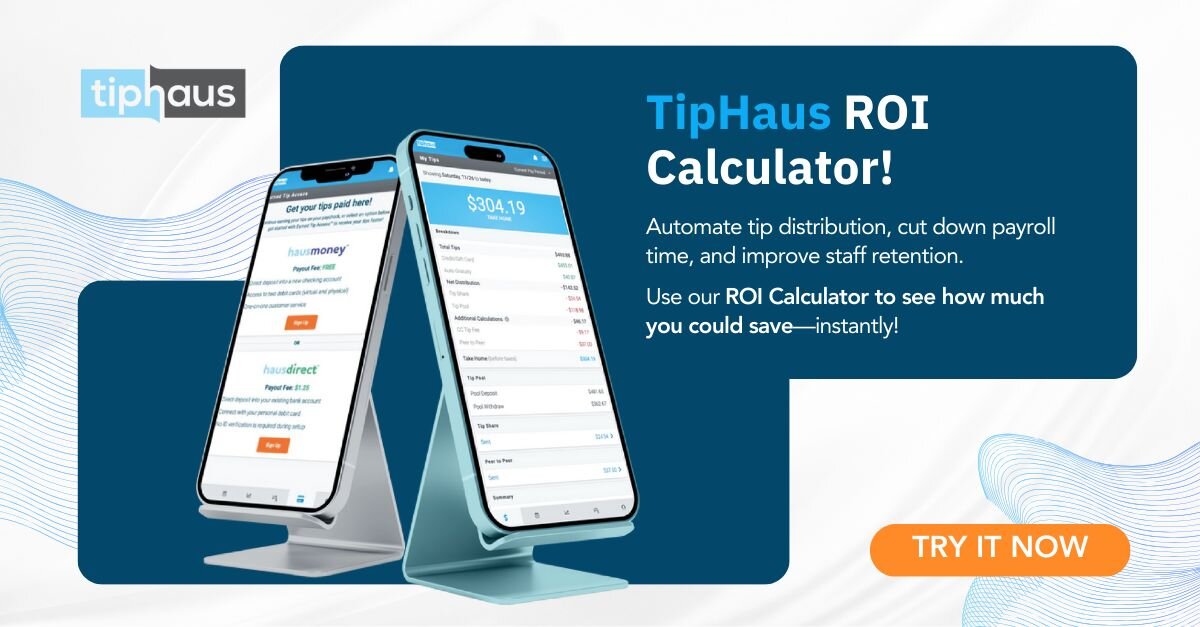

The complexities of tipping in Florida are much simpler with the right tipping software.

TipHaus is the industry expert on tip management, dedicated exclusively to helping restaurants, bars, and hospitality venues streamline their tipping processes. Unlike one-size-fits-all solutions, TipHaus goes beyond surface-level functionality to tailor every restaurant's tip structure to its unique needs. By focusing solely on tips, we deliver unmatched expertise and customization, ensuring our clients stay ahead in an ever-evolving industry.

Start your free trial with TipHaus to learn how we can simplify and make tipping in Florida fairer for your employees.